Opportunities and Challenges of Exporting Viet Nam Coffee to China

1. Market Potential and Viet Nam Coffee Export to China

1.1 Coffee Consumption Trends in China

China's coffee market is witnessing a clear shift from traditional tea to coffee consumption. According to the World Coffee Portal, in 2023, China surpassed the U.S. in the number of branded coffee shops, reaching nearly 50,000 compared to America’s 40,000. This surge indicates a rising demand for coffee in China—a country that cannot meet its domestic consumption needs and therefore relies heavily on imports.

Key suppliers of coffee to China between 2019–2024 include Brazil, Colombia, and Viet Nam. Viet Nam Coffee stands out as a strong contender due to its growing reputation and production scale.

Source: VICO Logistics

1.2 Factors Shaping Coffee Market Demand in China

1.2.1 Large Population and Rising Incomes

With over 1.4 billion people and rapidly increasing per capita income, China represents a high-potential market for Viet Nam Coffee exporters. As young and middle-class consumers shift from tea to coffee, average coffee consumption reached 2.5 kg per capita in 2022, a 7.1% increase from 2021. This signals a strong, growing demand where Viet Nam Coffee can play a leading role.

1.2.2 Rising Coffee Consumption and Changing Habits

Instant coffee is booming due to its convenience, aligning well with modern lifestyles. With the growth of online retail, consumers are now more exposed to diverse Viet Nam Coffee products. From 2010/11 to 2023, China's coffee consumption grew at an average of 21% per year—much higher than the global average—creating immense opportunity for Viet Nam Coffee exporters.

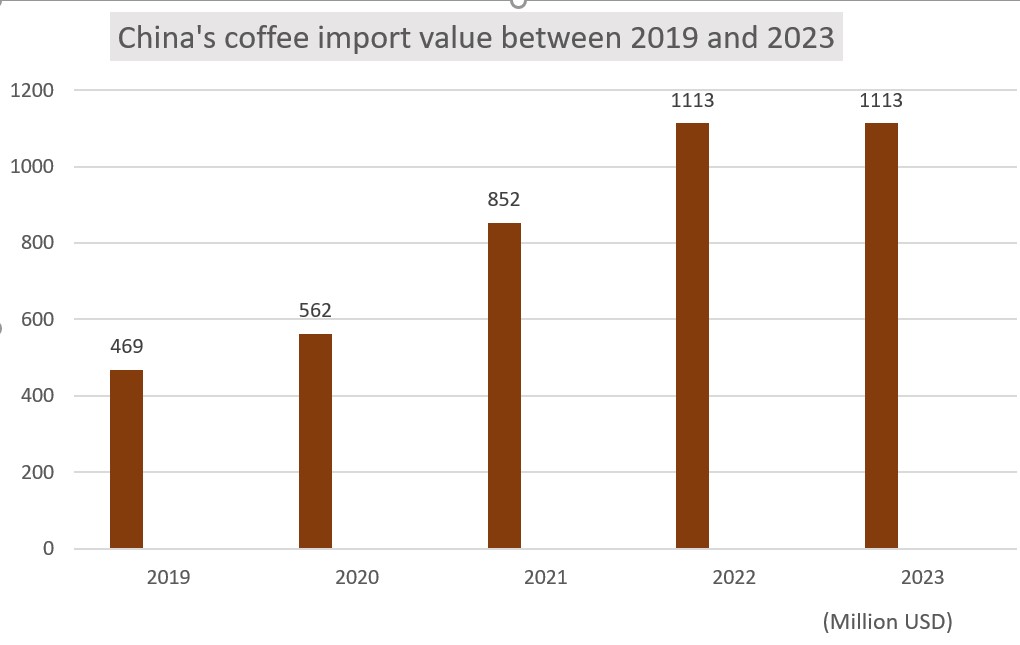

1.2.3 Rapid Import Growth

Between 2019 and 2023, China's coffee import value grew at an average rate of 25.5% annually, from $469 million to $1.11 billion. Despite this, local production remains insufficient, pushing China to rely more on imports—opening doors wide for Viet Nam Coffee to enter and expand.

Source: Vietnam Ministry of Industry and Trade

Source: Vietnam Ministry of Industry and Trade

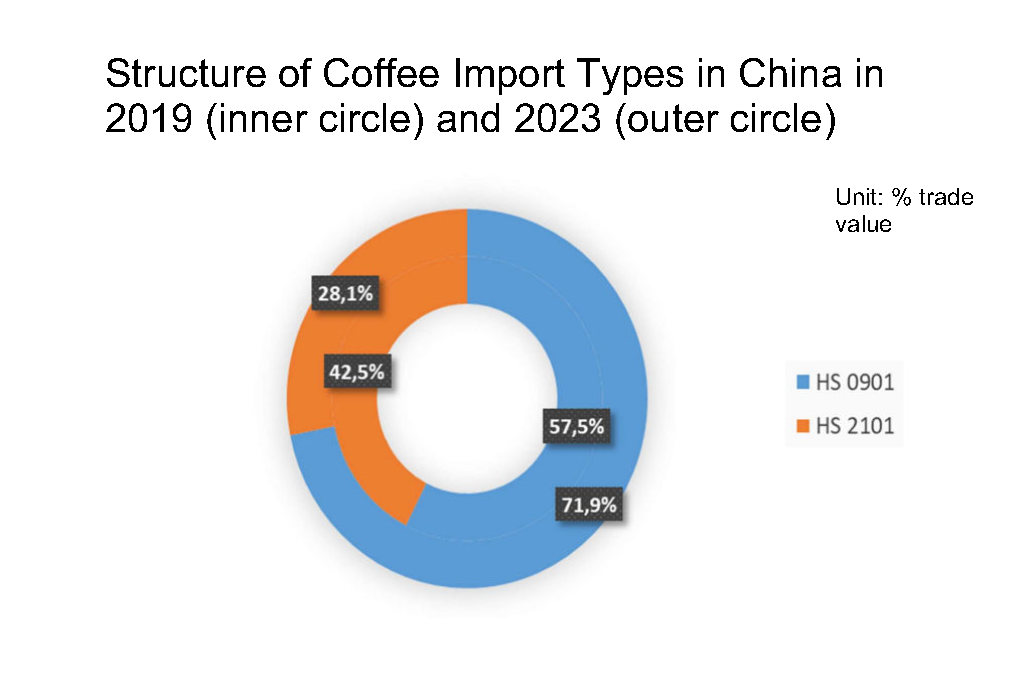

1.2.4 Shift in Coffee Import Preferences and Consumer Taste

Coffee Import category Structure: The share of green coffee beans increased from 57.5% in 2019 to 71.9% in 2023, growing at 33% annually. Meanwhile, instant and ready-to-drink coffee remained popular due to convenience, reaching $394.6 million in import value in 2022 before a slight decline in 2023.

China Consumer Habits: Young and middle-class Chinese consumers now favor high-quality, flavored ready-to-drink products. Sweetened, milk-based coffee and unique flavors are on the rise. While U.S. and European brands still hold sway, Viet Nam Coffee has the opportunity to capture more market share with innovation and product diversity.

HS Code | Category | 2019 (1.000 USD) | 2020 (1.000 USD) | 2021 (1.000 USD) | 2022 (1.000 USD) | 2023 (1.000 USD) | Average growth 2019 - 2023 (%) |

|---|---|---|---|---|---|---|---|

Total | 469.032 | 562.406 | 852.346 | 1.112.767 | 1.113.252 | 25,5 | |

'0901 | Green beans | 269.607 | 313.102 | 526.500 | 718.131 | 800.463 | 33,0 |

'2101 | Processed coffee | 199.425 | 249.304 | 325.846 | 394.636 | 312.789 | 14,0 |

1.2.5 Impact on Viet Nam Coffee Exporters

Although nearly 70% of China's coffee imports from Viet Nam are processed products, these only account for less than 20% of Viet Nam's total coffee export value. This reveals a limited capacity for deep processing in regions like Lam Dong. Viet Nam Coffee exporters must invest in processing technology and product diversification to compete more effectively in the Chinese market.

1.3 Competitive Advantages of Viet Nam Coffee in the Chinese Market

1.3.1 RCEP Tariff Preferences

The Regional Comprehensive Economic Partnership (RCEP) came into effect in 2022, aiming to remove 90% of tariffs among 15 member countries, including Viet Nam and China.

For the coffee industry, China has committed to deeply reducing import taxes on coffee products from Vietnam. According to a report from the Vietnamese Ministry of Industry and Trade in 2024, specifically the following HS codes:

- Instant coffee (HS code 2101.11.00): tariff reduced from 17% to 0% over 15 years.

- Roasted/ground coffee (0901.22.00): tariff exemption from the second year.

- Green coffee (0901.11.00): reduced from 8% to 5%.

These reductions significantly enhance the price competitiveness of Viet Nam Coffee, especially in high-value segments.

1.3.2 The flexible rules of origin make it easier for Viet Nam coffee to qualify for tax incentives.

RCEP applies simple origin rules, making it easier for Viet Nam Coffee to qualify for tariff preferences. As long as the coffee is grown and processed in Viet Nam, it qualifies. Enhanced traceability systems further support this, boosting credibility and compliance with Chinese import standards.

1.3.3 Improved Robusta Quality Matches Market Demand

- Production Capacity: Viet Nam’s Robusta output has risen steadily thanks to sustainable farming practices and advanced techniques. Viet Nam maintains one of the world’s highest Robusta yields, well-suited for instant and blended coffee—two fast-growing segments in China.

- Sustainability Certifications: Many Viet Nam Coffee farms are certified under 4C, Rainforest Alliance, and similar standards. This enhances both the reputation and export potential of Viet Nam Coffee in environmentally conscious markets like China.

1.3.4 Geographic and Logistics Advantages

Viet Nam shares a border with China, giving it a unique geographic advantage. Shorter transit times and lower logistics costs make Viet Nam Coffee more attractive compared to imports from Latin America or Africa. Combined with RCEP customs facilitation and digital trade systems, these factors make coffee export operations smoother and more cost-efficient.

2. Challenges in Exporting Viet Nam Coffee to China

2.1 Supply Limitations

Though Viet Nam ranks among the largest coffee producers globally, most exports are green beans. Meanwhile, China demands processed, branded, and high-value coffee products. The lack of modern processing plants in Viet Nam makes it harder to compete with global players like Nestlé or Starbucks.

2.2 Quality and Origin Transparency Requirements

Although Viet Nam coffee products are not required to have an export license under Circular 04/2014/TT-BTC, when exporting coffee to China, they must still meet a range of strict standards regarding quality and food safety. Businesses are required to provide all necessary certificates, including:

Businesses must have proper documentation

- Phytosanitary Certificate (issued by the Plant Protection Department)

- Food Safety Certificate (issued by Vietnam Food Administration)

- Quality Inspection Certificate

- Trademark Certificate (from China’s CNIPA)

Compliance also requires:

- Limits on heavy metals, mold, pesticides, antibiotics

- Accurate labeling (size, language, placement, etc.)

>> GACC Certificate: Passport to Legal the Coffee ship to China

Meeting these standards demands robust quality control from raw materials to packaging.

3. VICO Logistics’ Experience in Exporting Viet Nam Coffee

3.1 Full Export Support for Viet Nam Coffee Enterprises

VICO Logistics provides end-to-end assistance for coffee exporters:

- Pre-export: Advising on documentation, labeling, GACC/IRE registration.

- During export: Customs declaration in both Viet Nam and China, transport arrangement.

- Post-export: Problem resolution, shipment tracking, and customer support.

3.2 Practical Export Tips for Viet Nam Coffee Success

To succeed in China, Viet Nam Coffee businesses should:

-

Understand the Market: Understand the needs, trends, and shopping habits of Chinese customers. This helps in finding the right target market and creating the best coffee export strategy.

-

Choose reliable partners: Work with experienced importers, distributors, and agents who know the local market well.

- Improve product quality: Invest in better processing and use eco-friendly technologies to increase product value and improve coffee export chances to markets with high standards.

- Build a brand: Design packaging that fits Chinese culture, and use e-commerce platforms and social media to reach more customers. This helps position Vietnamese coffee in the minds of consumers and boosts long-term export success.

3.3 Useful Government Contacts for Viet Nam Coffee Exporters

| Office | Address |

| Vietnam Trade Office in China (Beijing) | No.32 Guanghua Road, Chaoyang District, Beijing, 100600 |

| Trade Office Branch in Guangzhou | Room 1304, 13th Floor, Guangzhou Peace World Plaza |

| Trade Office Branch in Kunming | Tai Long Hong Rui Hotel, 279 Chuncheng Road |

| Trade Office Branch in Nanning | Room 1919, Building 2, Hang Yang International Center |

| Trade Promotion Office in Chongqing | 12th Floor, Fuli Haiyang Guoji Building |

VICO Logistics has a strong partner network across China, supporting Viet Nam Coffee exporters with trusted connections and smooth logistics.

Learn more our coffee articles at

1. Factory Coffee: The Global Coffee Harvest Calendar and Seamless Export Logistics

2. Coffee Packaging Valves and China's Quality Standards

3. Green Coffee Beans HK: Global Packaging Standards

-----

VICO Logistics – Your Coffee Logistics Provider

Premium member of Eurocham, JCtrans, VICOFA, VITAS... associations

Owned offices: Hong Kong (headquarters), China (Shenzhen, Shanghai), Vietnam (Ho Chi Minh, Da Nang, Hai Phong).

Follow us for more valuable information

Book now: https://vico.com.hk/#quotation

Contact us:

Email mkt4_hcm@vico.com.hk (For business development)

Hotline: Zalo/Whatsapp: (+84)901877108

WeChat: miauyen157